EX-99.2

Published on February 27, 2020

Unlock the power of proteins TM February 27, 2020 Investor Call 4Q’19 and FY’19 Results; 2020 Guidance and Outlook Nasdaq: CDXS

Forward-Looking Statements • These slides and the accompanying oral presentation contain forward-looking statements that involve risks and uncertainties. These statements relate to future events or our future financial or operational performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results, levels of activity, performance or achievement to differ materially from those expressed or implied by these forward- looking statements. Forward-looking statements include all statements that are not historical facts. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “projects,” “predicts,” “potential” or the negative of these terms, and similar expressions and comparable terminology intended to identify forward-looking statements. These forward-looking statements represent our estimates and assumptions only as of the date hereof, and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. • Other factors that could materially affect actual results, levels of activity, performance or achievement can be found in Codexis’ Form 10-K for the period ended December 31, 2018 filed with the SEC on March 1, 2019 and Form 10-Qs filed with the SEC on May 8, 2019, August 6, 2019 and November 6, 2019, including under the caption “Risk Factors.” If any of these risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results, levels of activity, performance or achievement may vary significantly from what we projected. • Our logo, “Codexis,” “CodeEvolver®,” and other trademarks or service marks of Codexis, Inc. appearing in this presentation are the property of Codexis, Inc. This presentation contains additional trade names, trademarks and service marks of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply relationships with, or endorsement or sponsorship of us by, these other companies. February 27, 2020 Investor Call 2

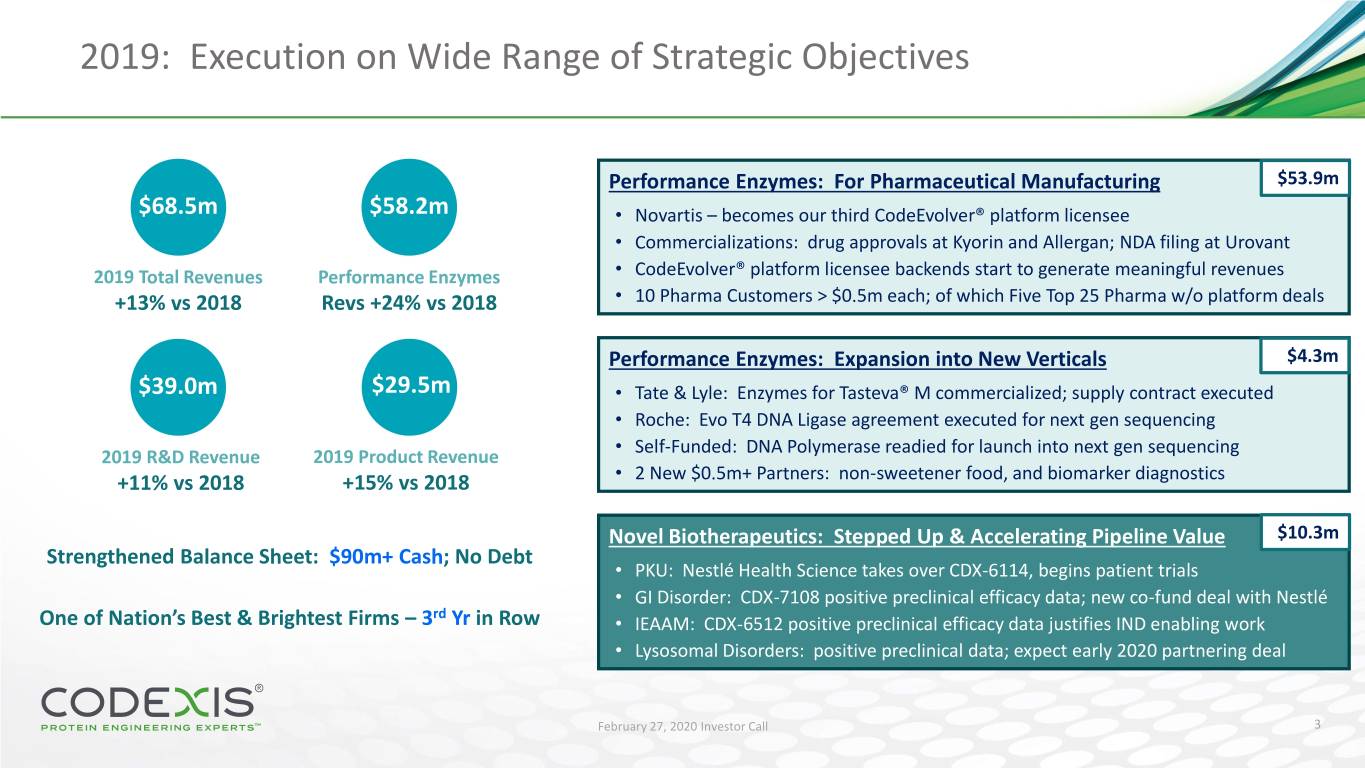

2019: Execution on Wide Range of Strategic Objectives Performance Enzymes: For Pharmaceutical Manufacturing $53.9m $68.5m $58.2m • Novartis – becomes our third CodeEvolver® platform licensee • Commercializations: drug approvals at Kyorin and Allergan; NDA filing at Urovant 2019 Total Revenues Performance Enzymes • CodeEvolver® platform licensee backends start to generate meaningful revenues +13% vs 2018 Revs +24% vs 2018 • 10 Pharma Customers > $0.5m each; of which Five Top 25 Pharma w/o platform deals Performance Enzymes: Expansion into New Verticals $4.3m $39.0m $29.5m • Tate & Lyle: Enzymes for Tasteva® M commercialized; supply contract executed • Roche: Evo T4 DNA Ligase agreement executed for next gen sequencing • Self-Funded: DNA Polymerase readied for launch into next gen sequencing 2019 R&D Revenue 2019 Product Revenue +11% vs 2018 +15% vs 2018 • 2 New $0.5m+ Partners: non-sweetener food, and biomarker diagnostics Novel Biotherapeutics: Stepped Up & Accelerating Pipeline Value $10.3m Strengthened Balance Sheet: $90m+ Cash; No Debt • PKU: Nestlé Health Science takes over CDX-6114, begins patient trials • GI Disorder: CDX-7108 positive preclinical efficacy data; new co-fund deal with Nestlé rd One of Nation’s Best & Brightest Firms – 3 Yr in Row • IEAAM: CDX-6512 positive preclinical efficacy data justifies IND enabling work • Lysosomal Disorders: positive preclinical data; expect early 2020 partnering deal February 27, 2020 Investor Call 3

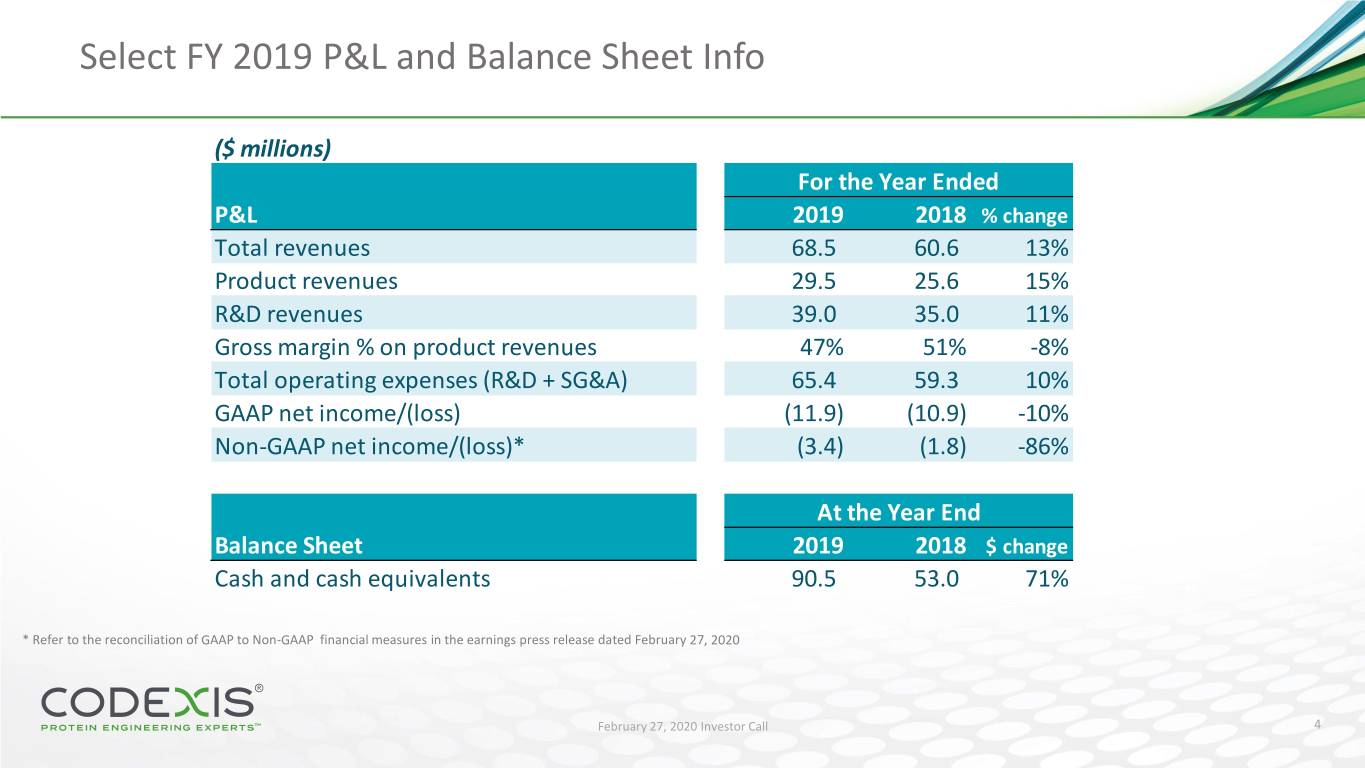

Select FY 2019 P&L and Balance Sheet Info ($ millions) For the Year Ended P&L 2019 2018 % change Total revenues 68.5 60.6 13% Product revenues 29.5 25.6 15% R&D revenues 39.0 35.0 11% Gross margin % on product revenues 47% 51% -8% Total operating expenses (R&D + SG&A) 65.4 59.3 10% GAAP net income/(loss) (11.9) (10.9) -10% Non-GAAP net income/(loss)* (3.4) (1.8) -86% At the Year End Balance Sheet 2019 2018 $ change Cash and cash equivalents 90.5 53.0 71% * Refer to the reconciliation of GAAP to Non-GAAP financial measures in the earnings press release dated February 27, 2020 February 27, 2020 Investor Call 4

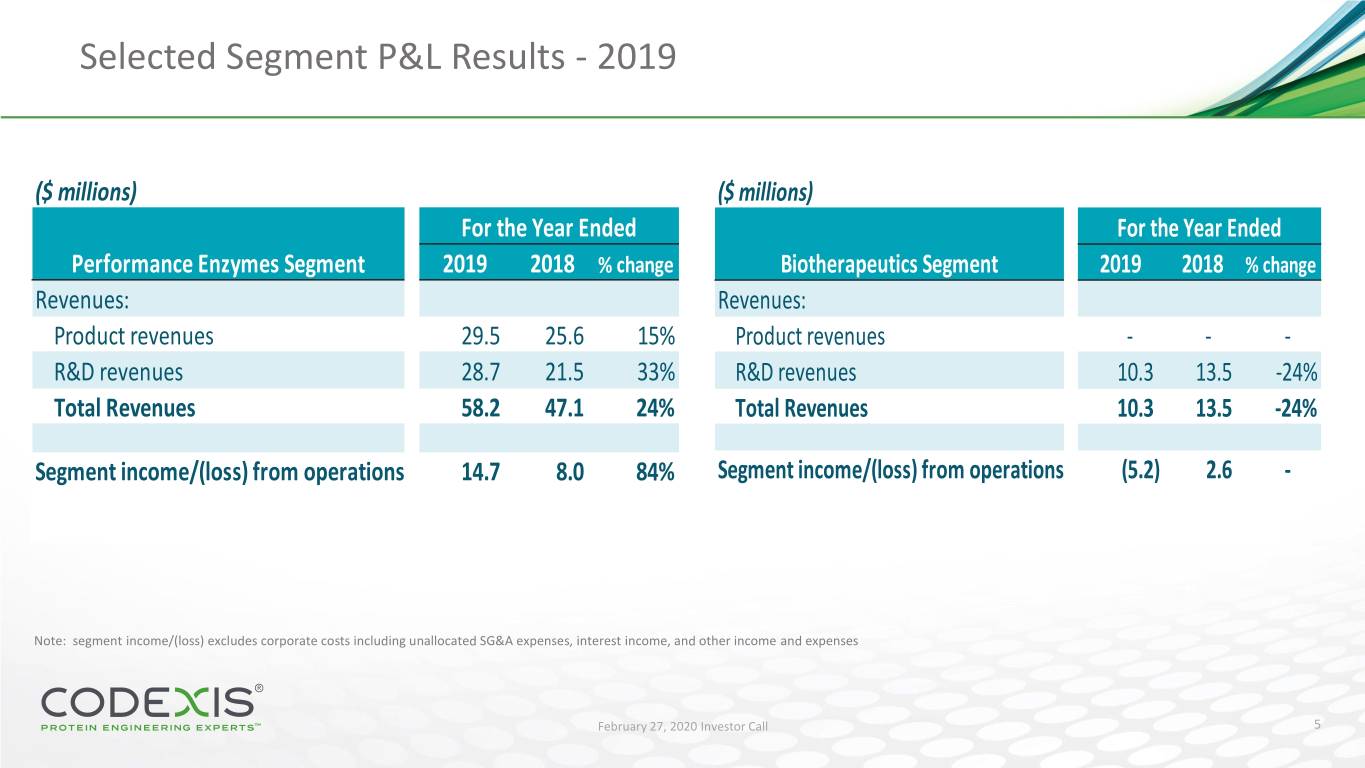

Selected Segment P&L Results - 2019 ($ millions) ($ millions) $68.5m $39.5mFor the Year Ended For the Year Ended Performance Enzymes Segment 2019 2018 % change Biotherapeutics Segment 2019 2018 % change Revenues: Revenues: Product revenues 29.5 25.6 15% Product revenues - - - R&D revenues 28.7 21.5 33% R&D revenues 10.3 13.5 -24% Total Revenues 58.2 47.1 24% Total Revenues 10.3 13.5 -24% Segment income/(loss) from operations 14.7 8.0 84% Segment income/(loss) from operations (5.2) 2.6 - $29.5m 47% Note: segment income/(loss) excludes corporate costs including unallocated SG&A expenses, interest income, and other income and expenses February 27, 2020 Investor Call 5

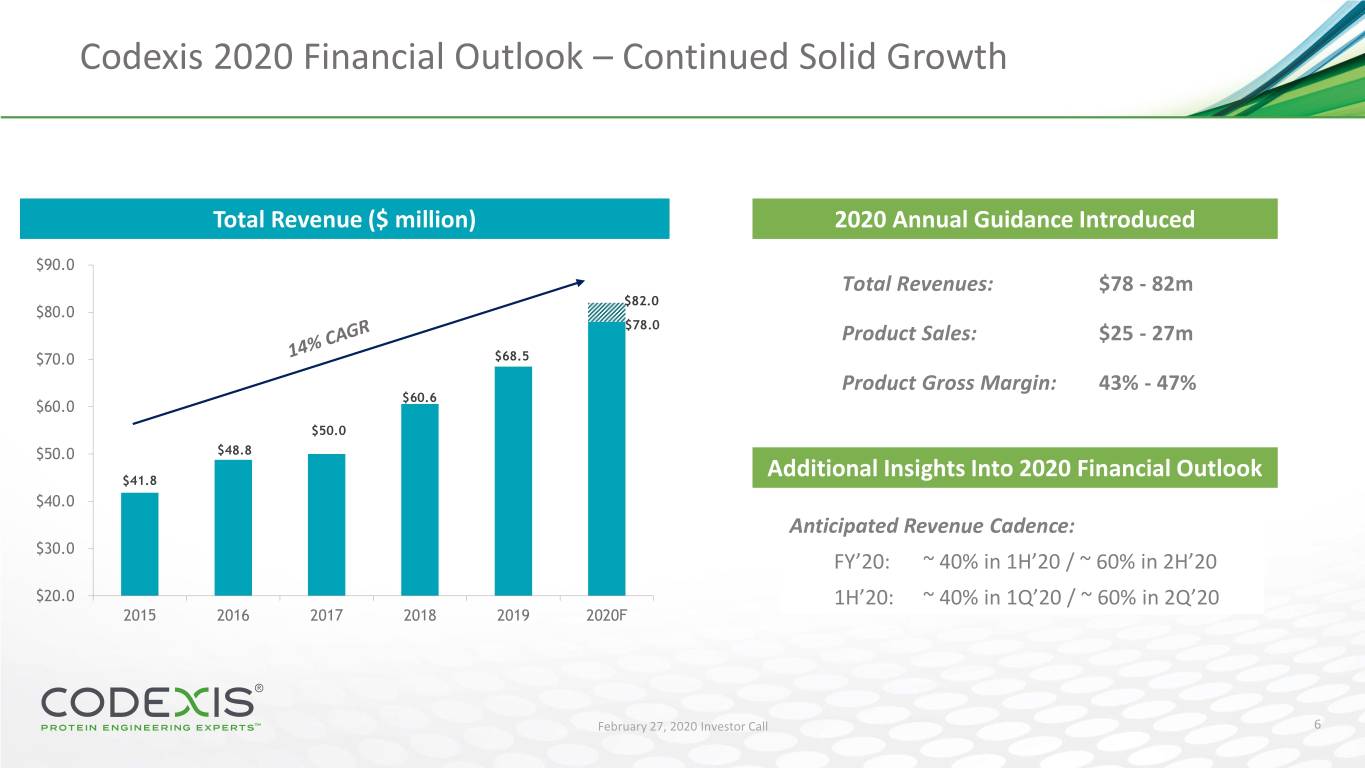

Codexis 2020 Financial Outlook – Continued Solid Growth Total Revenue ($ million) 2020 Annual Guidance Introduced $90.0 Total Revenues: $78 - 82m $82.0 $80.0 $78.0 Product Sales: $25 - 27m $70.0 $68.5 Product Gross Margin: 43% - 47% $60.6 $60.0 $50.0 $50.0 $48.8 $41.8 Additional Insights Into 2020 Financial Outlook $40.0 Anticipated Revenue Cadence: $30.0 FY’20: ~ 40% in 1H’20 / ~ 60% in 2H’20 $20.0 1H’20: ~ 40% in 1Q’20 / ~ 60% in 2Q’20 2015 2016 2017 2018 2019 2020F February 27, 2020 Investor Call 6

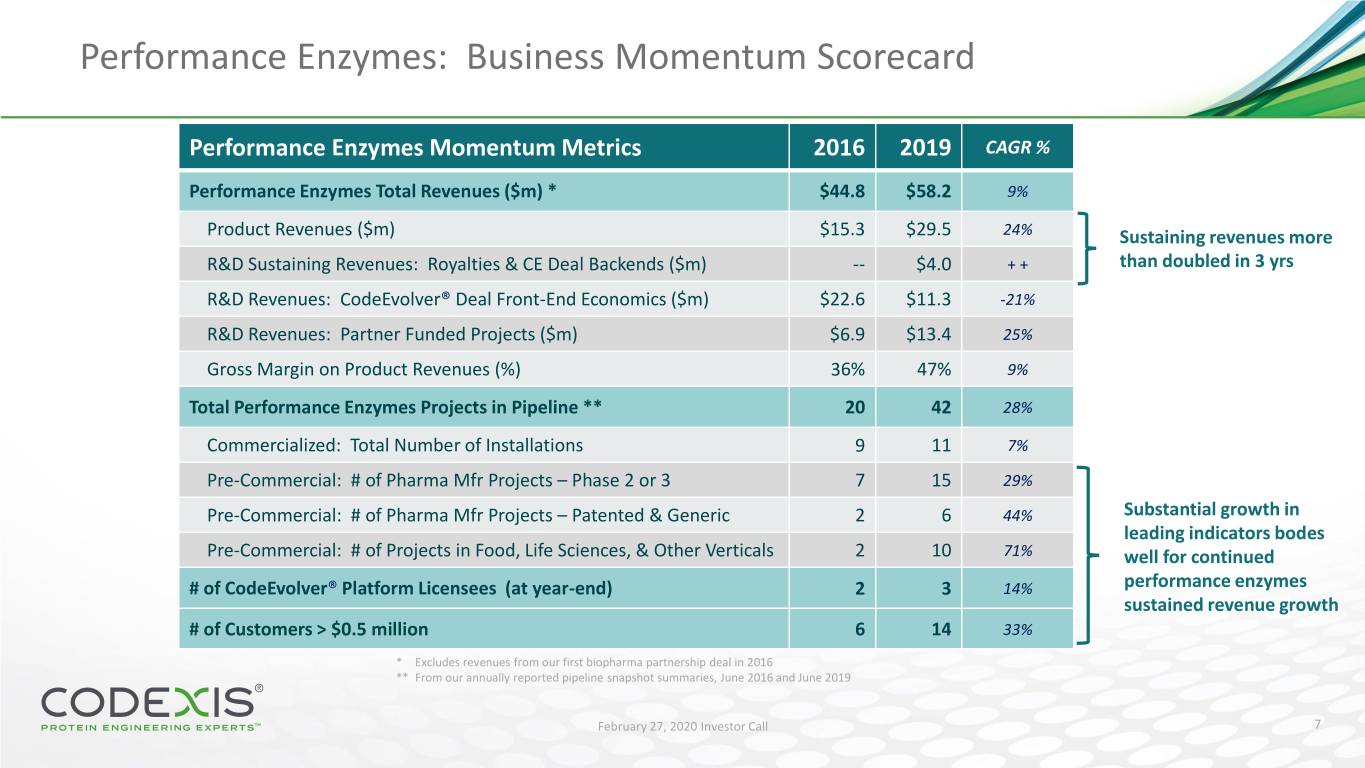

Performance Enzymes: Business Momentum Scorecard Performance Enzymes Momentum Metrics 2016 2019 CAGR % Performance Enzymes Total Revenues ($m) * $44.8 $58.2 9% Product Revenues ($m) $15.3 $29.5 24% Sustaining revenues more R&D Sustaining Revenues: Royalties & CE Deal Backends ($m) -- $4.0 + + than doubled in 3 yrs R&D Revenues: CodeEvolver® Deal Front-End Economics ($m) $22.6 $11.3 -21% R&D Revenues: Partner Funded Projects ($m) $6.9 $13.4 25% Gross Margin on Product Revenues (%) 36% 47% 9% Total Performance Enzymes Projects in Pipeline ** 20 42 28% Commercialized: Total Number of Installations 9 11 7% Pre-Commercial: # of Pharma Mfr Projects – Phase 2 or 3 7 15 29% Pre-Commercial: # of Pharma Mfr Projects – Patented & Generic 2 6 44% Substantial growth in leading indicators bodes Pre-Commercial: # of Projects in Food, Life Sciences, & Other Verticals 2 10 71% well for continued # of CodeEvolver® Platform Licensees (at year-end) 2 3 14% performance enzymes sustained revenue growth # of Customers > $0.5 million 6 14 33% * Excludes revenues from our first biopharma partnership deal in 2016 ** From our annually reported pipeline snapshot summaries, June 2016 and June 2019 February 27, 2020 Investor Call 7

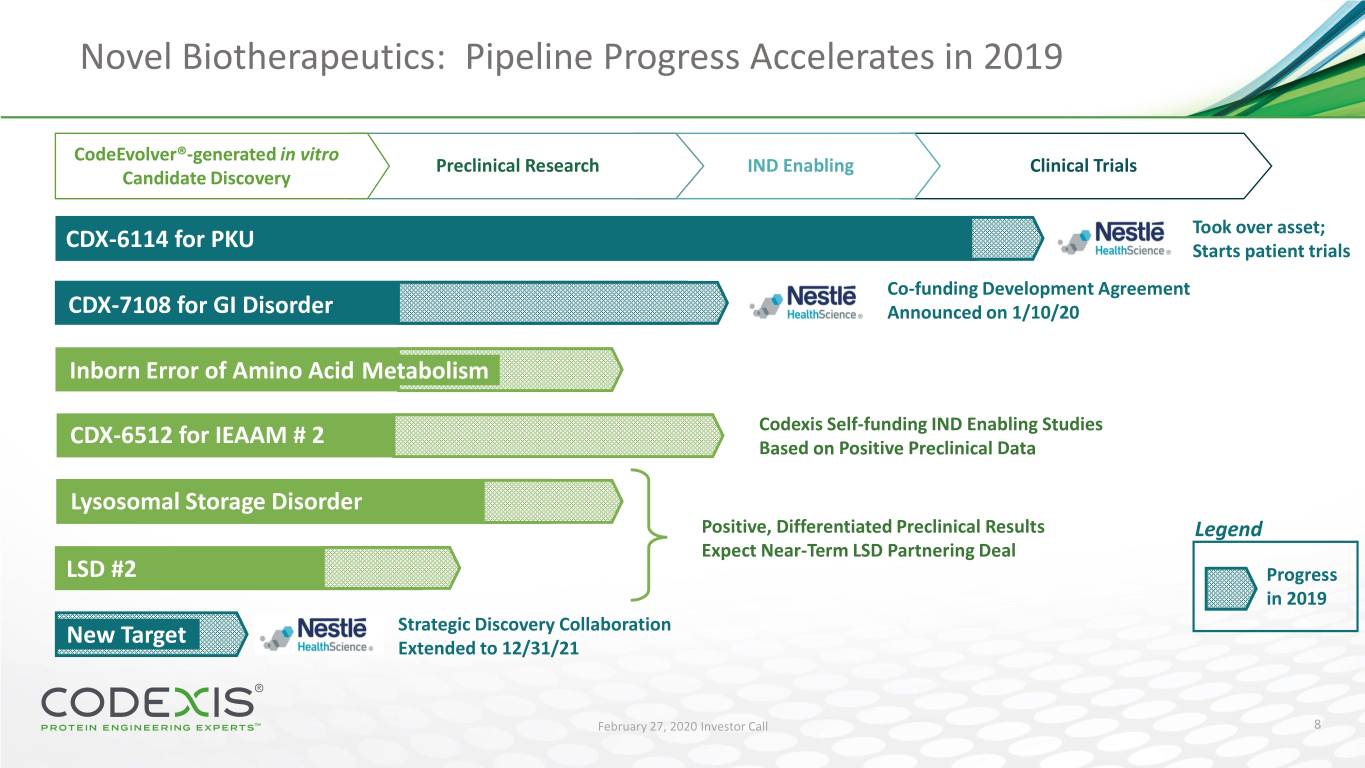

Novel Biotherapeutics: Pipeline Progress Accelerates in 2019 CodeEvolver®-generated in vitro Preclinical Research IND Enabling Clinical Trials Candidate Discovery Took over asset; CDX--61146114: for Inborn PKU Error of Amino Acid Metabolism (IEAAM) - PKU Starts patient trials Co-funding Development Agreement CDX-7108 for GI Disorder Announced on 1/10/20 Inborn Error of Amino Acid Metabolism Codexis Self-funding IND Enabling Studies CDX-6512 for IEAAM # 2 Based on Positive Preclinical Data LysosomalDrug Target Storage 1 (DT1) Disorder Positive, Differentiated Preclinical Results Legend Expect Near-Term LSD Partnering Deal LSD #2 Progress in 2019 New Target Strategic Discovery Collaboration Extended to 12/31/21 February 27, 2020 Investor Call 8

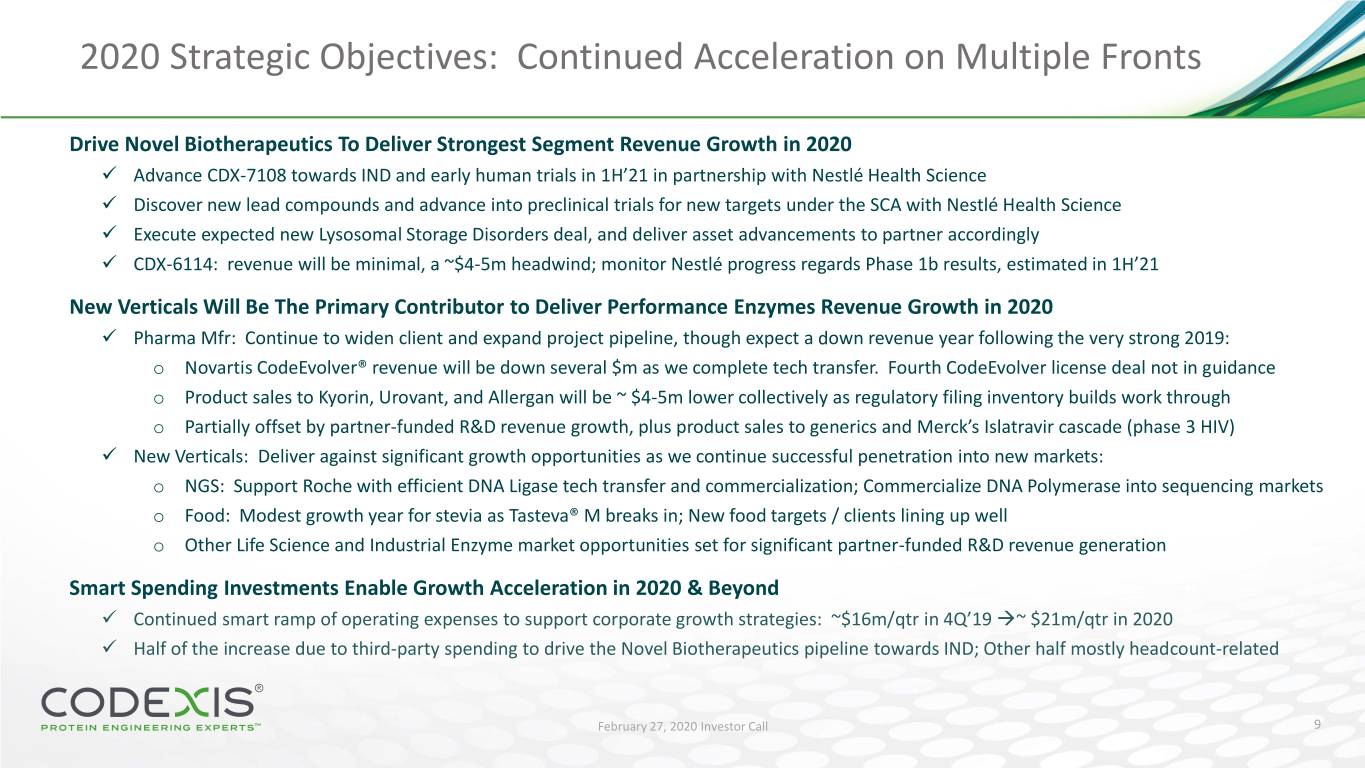

2020 Strategic Objectives: Continued Acceleration on Multiple Fronts Drive Novel Biotherapeutics To Deliver Strongest Segment Revenue Growth in 2020 ✓ Advance CDX-7108 towards IND and early human trials in 1H’21 in partnership with Nestlé Health Science ✓ Discover new lead compounds and advance into preclinical trials for new targets under the SCA with Nestlé Health Science ✓ Execute expected new Lysosomal Storage Disorders deal, and deliver asset advancements to partner accordingly ✓ CDX-6114: revenue will be minimal, a ~$4-5m headwind; monitor Nestlé progress regards Phase 1b results, estimated in 1H’21 New Verticals Will Be The Primary Contributor to Deliver Performance Enzymes Revenue Growth in 2020 ✓ Pharma Mfr: Continue to widen client and expand project pipeline, though expect a down revenue year following the very strong 2019: o Novartis CodeEvolver® revenue will be down several $m as we complete tech transfer. Fourth CodeEvolver license deal not in guidance o Product sales to Kyorin, Urovant, and Allergan will be ~ $4-5m lower collectively as regulatory filing inventory builds work through o Partially offset by partner-funded R&D revenue growth, plus product sales to generics and Merck’s Islatravir cascade (phase 3 HIV) ✓ New Verticals: Deliver against significant growth opportunities as we continue successful penetration into new markets: o NGS: Support Roche with efficient DNA Ligase tech transfer and commercialization; Commercialize DNA Polymerase into sequencing markets o Food: Modest growth year for stevia as Tasteva® M breaks in; New food targets / clients lining up well o Other Life Science and Industrial Enzyme market opportunities set for significant partner-funded R&D revenue generation Smart Spending Investments Enable Growth Acceleration in 2020 & Beyond ✓ Continued smart ramp of operating expenses to support corporate growth strategies: ~$16m/qtr in 4Q’19 →~ $21m/qtr in 2020 ✓ Half of the increase due to third-party spending to drive the Novel Biotherapeutics pipeline towards IND; Other half mostly headcount-related February 27, 2020 Investor Call 9

Thank you February 27, 2020 Investor Call 10